Budget stress or debt stress can happen to anyone, but if you’re in the red, we’ve found some resources to help.

As the cost of living rises and budgets take a hit, working out how much money you’d have to work with can make a big difference to what you spend. It’s why building a budget is so important, and one of the reasons why we’ve built our budget app to be fast and easy to use.

While other budget apps can make you jump through hoops or wait days to find out really what’s going on, ours is designed to be simple, just like the name.

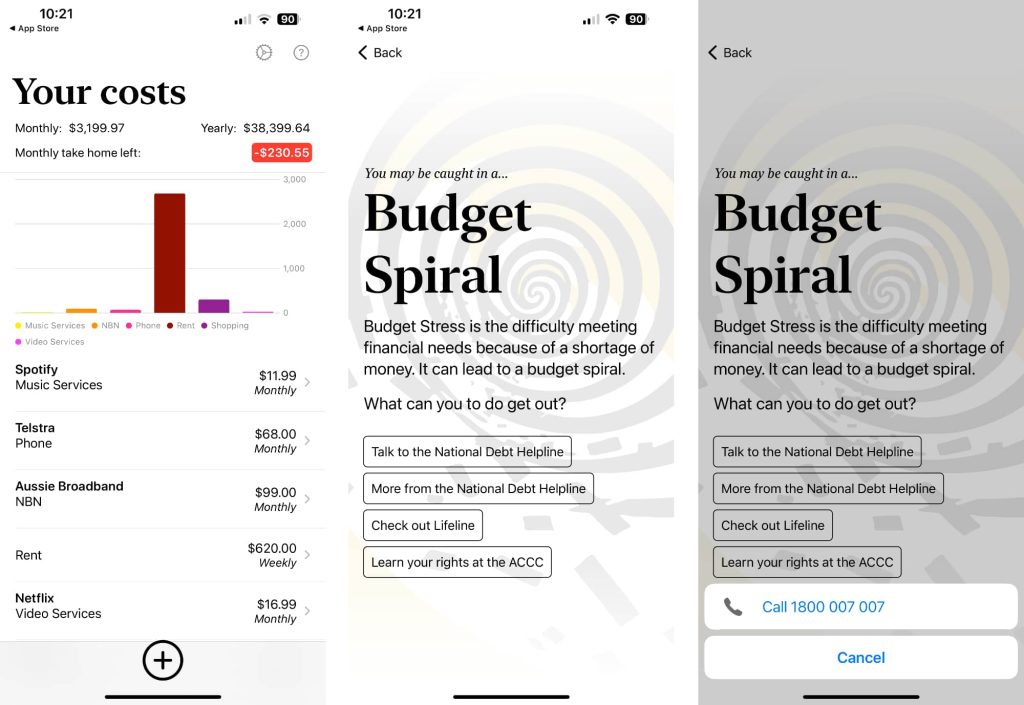

You simply add your costs and enter your salary, and the app will work out the rest, calculating how much money you should have left at the end month.

That’s important, because it can give you an easy overview of what you have to spend every month. You designate what you have to spend — rent or mortgage, shopping, phone, internet, and so on — and simplsaver will break down your spend into a graph, while totalling how much you should have left.

But while compiling a budget in simplsaver is pretty easy, the outcome will depend on your finances entirely, and if they go in the red, that can be bad news.

When a budget goes red, it’s a sign that you’re losing money each and every month, spending too much in the process. It’s an obvious sign of budget stress or debt stress, two terms that mean the same thing: financial stress that can overtake your life.

Increased stress can lead to a budget spiral, where your spending outpaces what you should have left over, and that’s a situation you don’t want to be in.

While no budget app can pay your bills for you, what we can do is find resources to help you deal with budget stress, and that’s what we’re doing with an update to the app.

It’s why we’re adding a “Budget Spiral” feature to the app aimed at linking those with financial stress to resources that could help put them on the right track, either with tips, strategies, or ways to talk to financial organisations and institutions.

Simply put, if your budget goes in the red, that dollar figure will turn into a button you can tap to show resources specific to your country aimed at helping you deal with financial stress.

Simplsaver works in the US, Canada, the UK, New Zealand, and Australia (where it was built), and each of these places has resources to help provide information about debt stress, and maybe offer some tips and coping strategies.

And these days, it’s critically important, especially as news of stress hits home for so many of us, happening the world over. In Australia, more Australians are in financial stress with the highest number since the pandemic, with similar stress pressures happening over in the UK and in the US, as well.

Everywhere is dealing with the pressure from financial stress, and overcoming it can be incredibly difficult.

It’s important to note that our app was built to help you make sense of your finances quickly and easily, taking stock of which costs and spends are important, and seeing what it would do to your budget if you quickly got rid of others.

However, we also think it’s important to help where we can, and finding resources relevant to those suffering financial stress is just as important as working out their budget, and may give some struggling with the cost of living just that little bit of help to get on top of it all.