Coffee, dining out, and manicures are just some of the things people are giving up. Can your budget account for them?

Rises to the cost of living are affecting everything we spend on, and depending on the age you are, there’s a good chance you’re experiencing things in a very different way.

According to the latest research from the Commonwealth Bank, spending for those over the age of 35 is greater than those under it, but even out of those numbers, Australians over the age of 54 are seeing more spending than anyone under it. That could be for many reasons, such as having more savings and fewer obligations, such as young children, rent or mortgage needs, or even the cornucopia of services younger Australians rely on.

It’s definitely having an impact on renters, the bank says, impacting its “Cost of Living Pressure Indicator”, which shows how high an individual’s total and discretionary spending is going on average.

“Our Cost of Living Pressure Indicator shows renters are experiencing more pressure than homeowners in general,” said Wade Tubman, Head of Innovation and Analytics at CommBank iQ.

“Despite the increased financial burden on some mortgage holders, a little under half of all homeowners are mortgage-free and a third of those with a mortgage have savings buffers of two years or more,” he said.

It comes amidst similar news that Australians still aren’t prepared to cut some extra things from their life and budgets that could be costing them big.

Those items are typically the creature comforts we’re all used to, such as coffee, eating out, and even the small personal things we do to feel good about ourselves like a manicure, with each racking up a cost on our budget.

So what can we do? And how do we weigh up the little things in our big budget?

How to budget for little costs that add up

With simplsaver, we’ve built an app that can account for little costs and big costs alike, because it all adds up and all takes away from your overall monthly take-home.

Whatever you spend, everything makes a dent, especially if you’re not thinking about it.

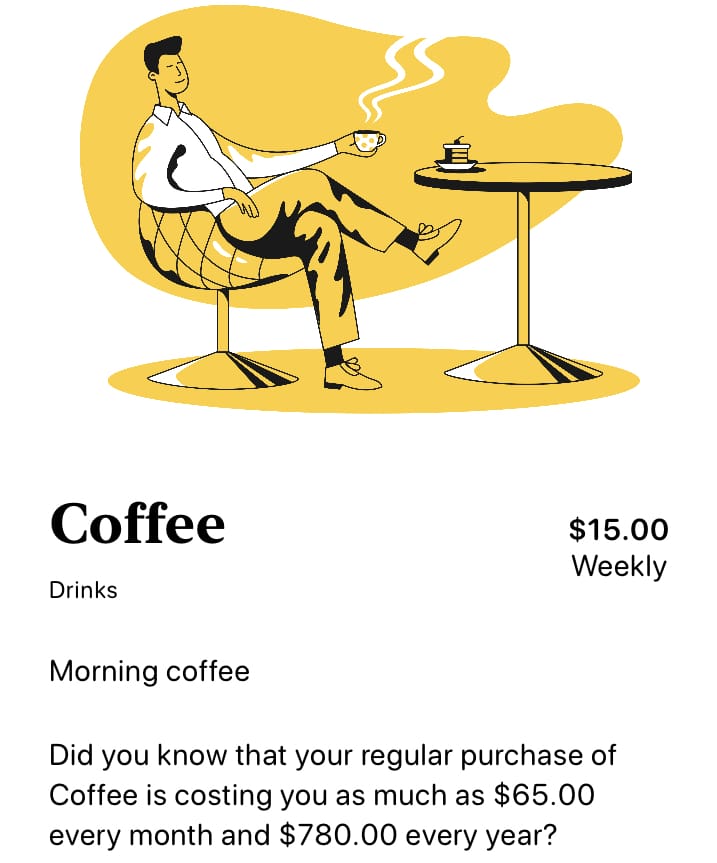

Coffee

With coffee, you can quickly add how much coffee you drink to a simplsaver budget, and see how much your regular consumption is costing you in the end.

If you have a $5 coffee three times a week in the morning, that’s $15 a week and as much as $65 a month.

Increase the amount and the cost of coffee, and that cost can go up considerably, compared with cutting back or switching to something else.

Eating out and ordering in

The creature comfort that is eating out or even ordering in can cost a sizeable sum, even if it’s once a week.

A $120 lunch with your partner could be $120 every fortnight, which in turn translates to as much as $260 every month, and as much as $3K in a year.

Ordering in has the same problem, too. If you order in once a week at around $100 each time, you’re spending a little over $400 monthly on food delivered to you. Alternatively, if you just spend on a one-off dinner, that’s something you can add, as well.

Understandably, this can all make a sizeable dent on a budget.

Manicures, hair appointments, and more

And if your regular spend includes a regular appointment to fix your nails, hair, or anything else to make yourself look or feel better, these too can make a dent on your budget in ways you may not be thinking about.

Depending on what you’re after, a manicure can cost as little as $25 and push on much higher. Do this once a week and you’re looking at around $100 per month.

Budget for the little things to make them count

We’re not saying you shouldn’t do any of these things, either.

People will drink coffee, just like they’ll also go to the pub and order a beer, eat out with their friends, and do more that affects their budget in the littlest of ways.

What we are suggesting is to find ways to make all of this count, so you realise how much of an impact each one of these spends has on your budget.

At the end of the day, if you know a regular coffee three times a week is costing you X much, you may be able to cut back ever so slightly and reduce its hit on your budget just that little bit more. The same goes for eating out and other costs.

Once you know what you spend, you can get on top, and maybe find ways to cut back in other area to keep these other little costs balanced.