Budgets can seem like they’ll be complex and take forever, but with simplsaver, you can understand your budget quickly and easily. Here’s how.

Budgeting isn’t for everyone, even though everyone has a budget whether they realise it or not. And whether they want to or not, too.

The problem with money is that it’s always being used for something, and whether or not you have an active budget, your finances are being spent somewhere. It could be for your housing situation, food, shopping, or maybe something for your entertainment, with the seemingly endless number of services we all subscribe to.

You may not intentionally have a budget, but chances are that you have one anyway. It’s just part and parcel of life.

The problem with having an automatic budget is that you may not be able to necessarily work out where all the money is going.

If it feels like your finances are disappearing before your very eyes, even though it doesn’t seem like you’re spending it, you may have a hole in your budget you’re not aware of. That could be something eating away at your finances that you’re not aware of, or it could even be that you’re not aware of what’s going on in your budget.

And that is where simplsaver can help.

Start with what you know

Creating a budget in simplsaver can take as little as 60 seconds, and really just has you start with what you know about.

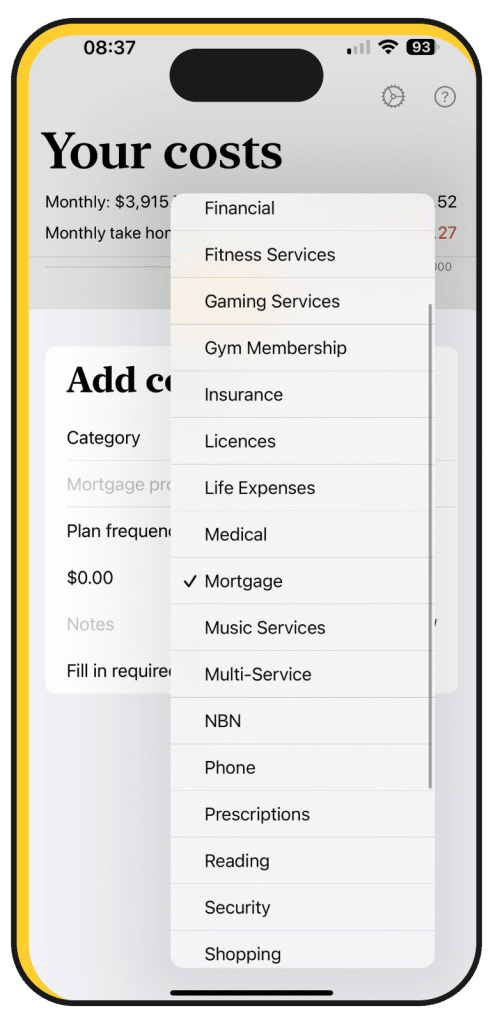

Enter the costs you can think of first. Basically, start with the costs on the top of your head, such as:

- Your phone service

- The internet costs

- How much you spend on groceries regularly

- Prescriptions costs if you have them

- A rough amount for petrol and/or public transport

- The cost of your home (rental or mortgage)

- Entertainment services you pay for (we’ve prepopulated the costs for you, because remembering is impossible)

Those costs will likely be the big ones you can think of, and are pretty easy to start building a budget with.

Look at your bills and finances for more

There will be a lot you can’t remember, though. Lots of little things that add up and are eating away at your budget, often without you realising.

Log in to your bank account and read through the list of debits, working out what comes out regularly and that you’re paying for.

Regular payments that could easily chip away at your finances are likely to include:

- A car loan

- Insurance costs

- Gym membership

- Childcare

- Licenses

- Utility payments (electricity, water, council rates)

- Subscriptions,

- And other services you mightn’t be thinking about

There are a lot of things that could be coming out automatically, affecting your budget, even if you’re not aware of it happening.

You may not be planning an actual budget, but chances are your budget is still going to be hit by automatic and regular payments all the same.

Adding as much as you can to complete your personal budget is one way to make sure you’re aware of how much everything costs.

You can make this as complex and granular as you want, bringing it down to how many coffees you consume weekly and how many of one individual item you end up buying regularly, such as spending on a dozen bottles of wine monthly. Alternatively, you could simplify it ridiculously to only broad things that matter. It’s entirely your choice.

It’s your budget, after all.

Add your salaries to get the whole picture

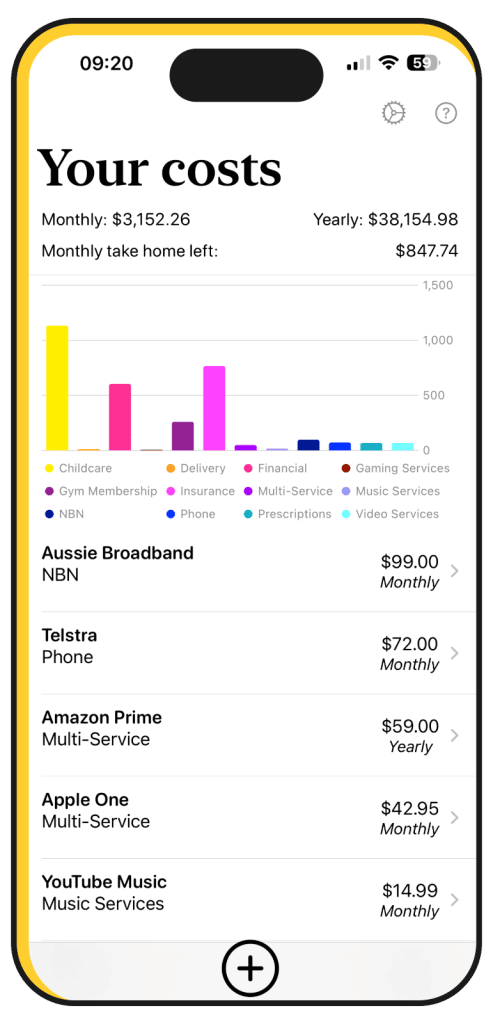

The final thing you may want to do with a simplsaver budget is to add your salary, because this will show how much of your money is left at the end of each month.

Whether you’re living on one salary or have two in a couples relationship, you can enter your take-home after tax into simplsaver’s settings, and it will show what effect your costs are having on your budget monthly.

In short, the simplsaver budget app is providing a way to see where your money goes and how much you have left at the end of the month.

You’ll still probably have other expenses you won’t be including. It’s next to impossible to account for every cost entirely, because things can and will change, and you’ll end up spending money that isn’t “regular”.

If you have $500 left over each month, that remaining money could be saved, but it could also go to something else. The occasional shirt or pair of shoes, or maybe even something nice for yourself. A lunch, a drink, etc. One off expenses happen more often than once, and aren’t something you’ll likely account for in a budget.

What simplsaver does is make you away how much you should have after all the big and little costs have been added, and it does it only on your phone simply and easily.