Not everyone needs a budgeting app to show how much money they have left. If you just need an expense tracker for one-off expenses, our app can do that, too.

There are a lot of things in your budget that will be regular, from monthly bills or weekly shopping spends, not to mention all those regular services that come out, too. Most of these things are easily tracked to get you a gauge of what you’re spending on the whole, but then there are other things, too.

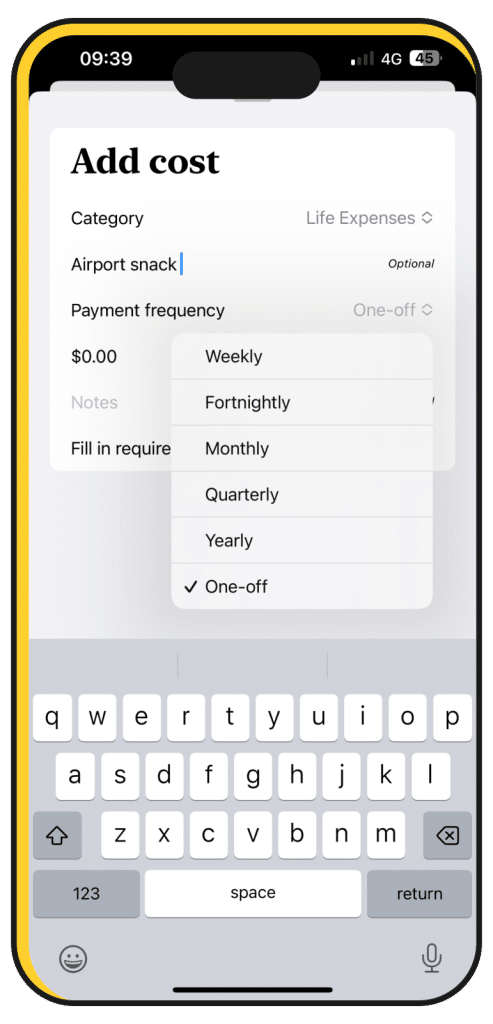

While regularity is often how you can easily understand your budget, irregularity is the nature of life. Things just happen and costs just appear; not everything matches to a weekly, fortnightly, monthly, quarterly, or even yearly schedule.

So we’ve added an optional to simplsaver to account for those costs that don’t adhere to regular cycles: one-off.

What is a one-off payment?

As the name suggests, a “one-off” payment is a single use payment you’ve made once.

It could be buying a piece of software or app, a beauty appointment you made because you felt you needed to do something for you, the TV you’ve been thinking you’d buy, or maybe something small you don’t plan to do every month.

Even though a lot of what simplsaver is made for is regularity, we all have one-off payments that affect our budget, so you can find “One-off” under payment frequency of nearly any item that can be applied to that.

Services with pre-populated data won’t offer that — because they’re always reliant on a regular payment — but just about anything else is, and it will take itself out of your budget as the one-off payment that it is.

How to use simplsaver as an expense tracker

While we’ve built simplsaver to be a tracker for the regular payments, you don’t have to use it like that. As it is, you can already use the app to work out how much a first home would cost beyond the typical home loan calculator, not to mention how much drinks are costing you from your regular coffees and nights on the town.

But now with a one-off payment, you can also use simplsaver as an expense tracker, working out how much the little expenses have added up to.

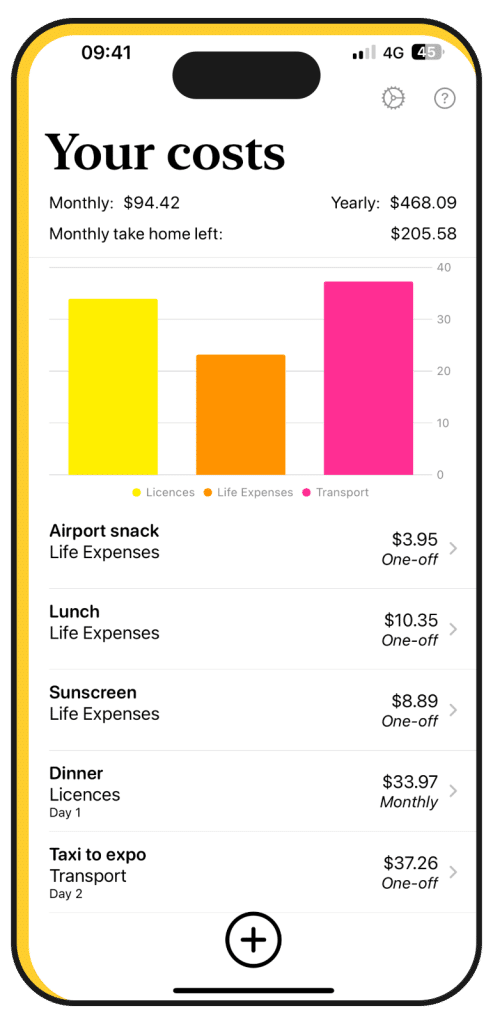

To use simplsaver as an expense tracking app, simply add the items you want to add, and select their regularity, likely as “One-off”. In fact, if you have a budget while you’re on a business trip, you can apply a bit of a hack to simplsaver to work out how much your expenses are costing you.

A hack to track expenses while on a trip

Because simplsaver is built like a monthly budget tracker, you could enter your trip budget as the monthly budget in settings. That’ll give you how much you have to spend on this trip, though you could ignore the yearly amount unless you regularly have these trips 12 times a year.

Then just throw in costs as you get them. You might buy a few drinks, and you might have a taxi ride or two that you can throw into transportation.

Your costs will quickly begin to add up, and you can see how much of your work trip budget that you have left as you add them. It’s that easy.