Mortgages are about to go up yet again in Australia, as the Reserve Bank adds more to what home owners pay, and your finances drop just that little bit lower.

Spare a thought for anyone paying off a home loan right now, because they probably don’t have it easy. While interest rates are on the up for much of the developed world, Australia has just seen its 9th raise since near the middle of last year, and it won’t be a move celebrated by many.

Older generations may cheer from a slight increase to their savings, but anyone paying off a mortgage is about to see more of their salary go towards that home, and that’s not going to be welcome knowledge.

This week, the Reserve Bank of Australia pushed the rates up to 3.35%, making a home loan just that much more expensive (and less affordable), and more are expected later in the year.

It’s news mortgage payers won’t want to hear, but the knowledge of more potential rate increases on the horizon could provide some understanding of what to do next, particularly if it means reserving more of your finances for increases in home loan repayments.

Work out how much your rate is going up by

There’s likely no stopping it, but you can find out how much your rates are going up by knowing what your current payments look like.

Check your bank statements and/or a recent home loan statement to find your interest rate, and then throw those details into a mortgage calculator to work out what an increase of 0.25% will do to your payments.

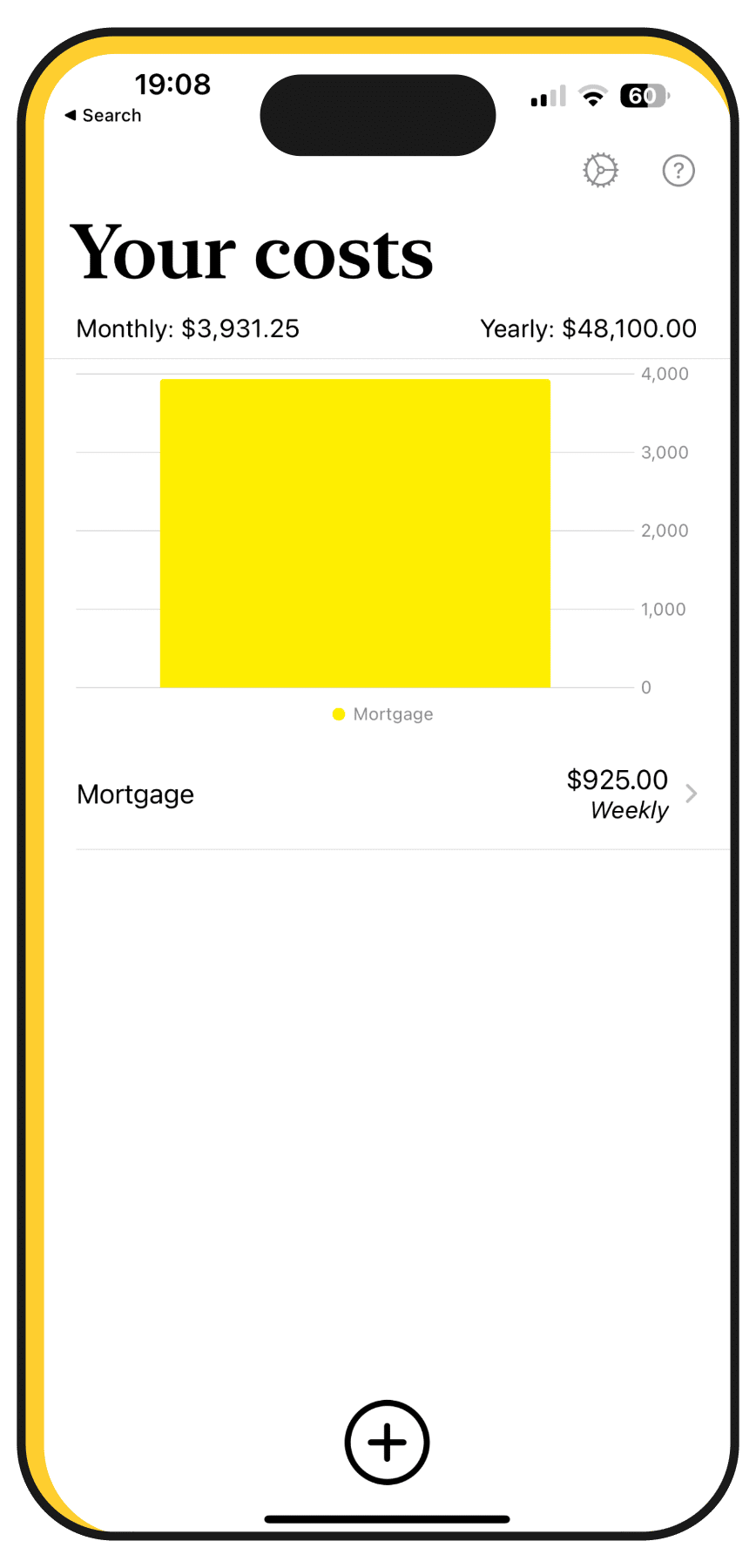

Once you have that amount, add it to simplsaver as a mortgage payment, using weekly, fortnightly, or monthly, depending on how you pay for your home loan. For instance, if you pay for your mortgage weekly, enter that new expected mortgage repayment in.

While the news is quite fresh from the RBA’s rate hike in February, and few banks or lenders have chimed in, a rate hike of 0.25% is more or less guaranteed to be reflected in lender rates. Add that number to your interest rate if you’re on a variable rate already, or if you’re about to switch from a fixed rate to a variable, take the current average interest rate and add 0.25% to the mix.

Calculate using a home loan calculator, and throw that sum into simplsaver. Immediately, simplsaver will show you what repayments will cost, and if you know your salary, you can even see the dent that cost will make on your monthly take home.

Budget for the rate increase

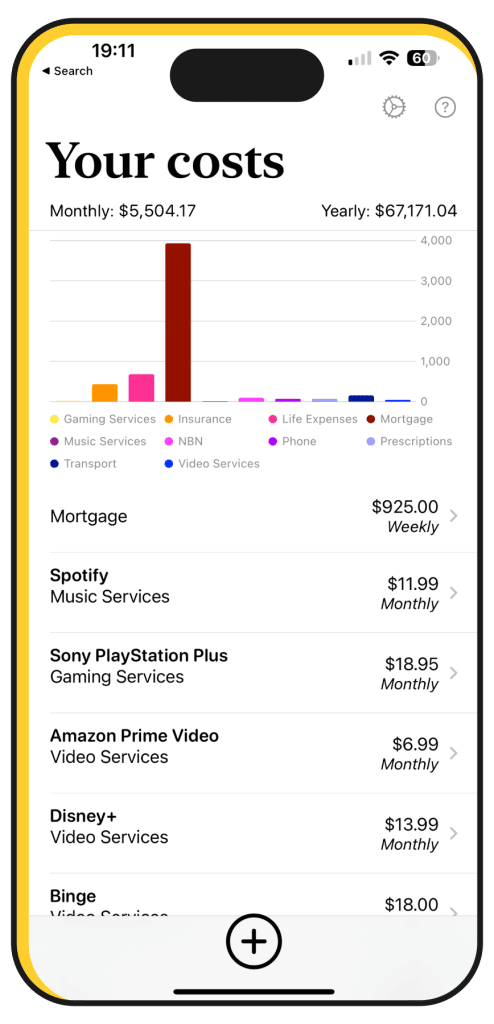

But there’s more we can do, and simplsaver can let you see what the rest of your costs are doing to your take home.

Your mortgage will very likely take up most of your salary, but throw in everything else, you can help explain your own budget.

If you subscribe to Spotify, throw it in. If you subscribe to an abundance of video and gaming services, load them in. Add in costs for the gym if you go, regular petrol, insurance types, newspaper subscriptions, how much groceries normally cost you, childcare, and also your phone and broadband services, as well.

Enter in everything that costs you a regular amount of money, and simplsaver will calculate your personal budget entirely on your device.

With this information, you can see whether those new mortgage repayments will be able to work side-by-side with the rest of your budget, and then see if there’s something you can get rid of, or even reduce.

A simplsaver budget can take as little as 60 seconds, and once all the information is there, you can simply swipe out costs you don’t think you need, changing how much of your monthly budget you have available to you.

You’ll still need to make the changes in real life, but simplsaver’s approach to budget apps can explain what your budget is doing, regardless of whether or not you have an active budget.

Given the fact that rates are expected to rise, it’s entirely possible your monthly budget will need to be adjusted several times throughout 2023 as the rates and repayments change.

Of course, there are other things you can do, such as refinancing to a lower rate, be it with a bank or a mortgage broker, but ultimately being aware of just what your budget is doing and staying in control of your finances could be what you need, especially with more on the horizon.