Before I started toying with the idea of making an app, I checked out everything. It turns out I didn’t need a budget planner; I needed a budget explainer.

Life can be hard and overwhelmingly complex. Even when you have a budget, things can just begin to spiral, because life can be hard and overwhelmingly complex.

You’ll have your regular finances and things to pay — the must-haves and necessities that keep the lights running and your home paid for — and then the other things that help you live day to day. But these can quickly spiral out of control, and often through no fault of your own.

We’re in a bit of a cost of living crisis, which means prices are going up, and fast. That can and will likely have an effect on your budget, because every time something changes, you’re possibly not reevaluating just what’s going on, and your budget is still set from before anything was changing.

In short, you could have planned your budget perfectly, but change can mean your budget is no longer sound, and those finances are still coming out. And depending on how many you have, they could easily begin to get very unruly.

Budget spiral

The more I looked at our finances last year, the more I became convinced that budget planning wasn’t really the problem. We were budget planning, but rising costs were making our budget awkward. When interest rates would jump, our mortgage repayments would go up, and that happened repeatedly last year with each leaving a lasting impression.

It wasn’t just the mortgage, but everything:

- Water went up.

- Energy went up.

- Insurance went up.

- Food went up.

- Entertainment services went up.

- Petrol and fuel went up, and may go further this year.

Everything went up, and despite our budget planning, our finances were seemingly going down.

Our budget planning wasn’t the problem. Our budget needed explaining. It had begun to spiral due to the rising cost of living, and we needed to know where the money was going, and why it was disappearing from our budget so quickly. That in turn would help us nip it in the bud and help fix our finances.

Simply explaining an in-use budget

That’s what simplsaver aims to solve.

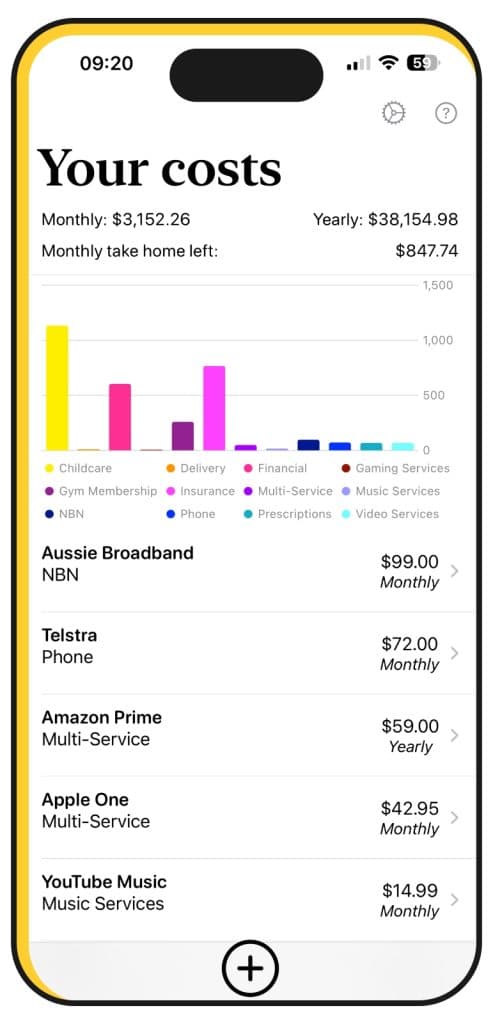

Rather than be a regular budget planner, it’s more of a budget explainer. You throw in your costs and expenses, and match it up with how much you’re making weekly, fortnightly, or monthly. The result is what you’re spending and what you have left over.

This is a budget explainer, because it can say how much money you have left from every spend, not just the ones you’re thinking about. We want you to think about every cost, and we want it to be easy to read in black and white.

In simplsaver, your costs are up front on the main screen, explained and at the top of everything. Monthly then yearly, and if you’ve entered your salary, the amount that’s left is just below it.

Your budget is explained, and you can sort through the list of spends to see what you have, how much it costs, and if you click on each one, how much each costs you yearly.

Budget secured

Importantly, all of the information is kept on your device. Just to you. Only to you.

I write about security in technology journalism and see leaks all the time. They’ve become so frequent, they’ve pushed beyond reading about them in technology circles to become everywhere. Optus. Medibank.

You only need to chuck your email into Troy Hunt’s “Have I Been Pwned” to see a leak that’ll affect you.

So rather than deal with that, simplsaver’s privacy policy is kept in line with the rest of its approaches: simple. We don’t store anything, you store the data on your device.

A simple budget

As development kicked on with our simplsaver budget explainer, we could see the stressors and where the cracks were forming in our budget. We’ve started to pull back on things, change others.

While built as a budget explainer, simplsaver also works as a form of budget forecaster, giving us a look at what a regular month will be, and allowing us to delete items quickly to see what their impact would be on our budget monthly.

It’s simple to do, because it’s in the name, and hopefully can help you, too.