Like so many people, I used to have a budgeting spreadsheet, but it wasn’t doing my budget justice. It took developing an app to work out why.

When I first started building simplsaver, it wasn’t to analyse and understand where my money was going. Rather, it was to understand how much money I spent on services. But it grew, and partly because it started to make more sense than simply having a spreadsheet for costs.

I could throw anything in there. The obvious things to calculate were the entertainment services, but there’s more that we spend our money on, so I threw in everything, dividing it by category. I thought of anything that was a regular spend and everything that came out automatically. I needed to think of the things that I wasn’t thinking about to get on top of my finances, and this app could do that.

So how do I use simplsaver? I add everything piece by piece.

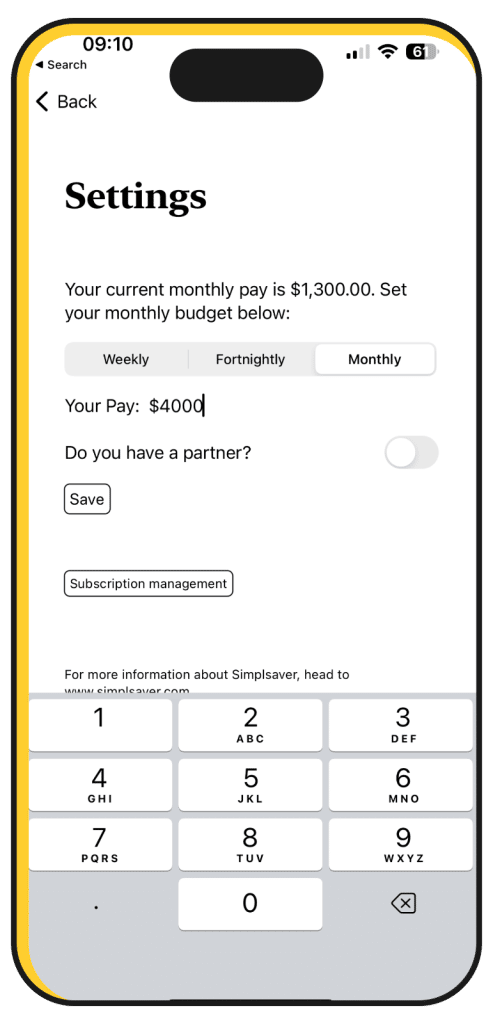

Step 1: Add your salary take home

Start in the settings page, which is the little cog icon on the top right. It’s here you can set a weekly, fortnightly, or monthly take home amount, and even add one for your partner.

Get a complete picture, and don’t worry: this is stored only on your device. Everything in simplsaver is stored only on your device.

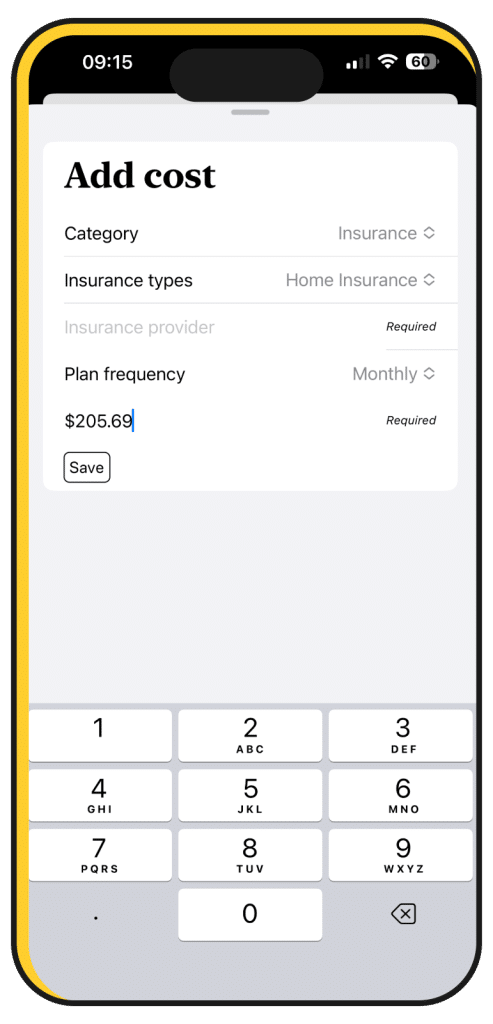

Step 2: Start with the things you think about

To get a budget analysed and counted in simplsaver, start with the things you’re thinking about that you know you have. Phone. Internet. Music services, such as Spotify or Apple Music. You know what’s next? Video and gaming services.

Add in Netflix, Disney, and so on and so on, and if you subscribe to Xbox or PlayStation, add those, as well.

If you subscribe to Apple One, head to “Multi-Service”, because that’s one of those services that covers more than just one area. Amazon is also there, if you use that, or you can add it as Amazon Prime in the video section.

Once you have the things you actively think about in your budget, it’s time to think about the things you don’t think about.

Step 3: Add insurance, childcare, mortgage, and other necessities

Those things that you don’t think about are likely the ones that take a huge chunk out of your budget, and you’re probably left none the wiser.

They’re the things happening automatically that you need, like your health insurance, car insurance, home insurance, and maybe even life insurance. If you have kids, it’s possibly a weekly childcare payment, a mortgage or home loan you’re paying back, and maybe even a car loan.

If you own a home, add in council rates and water, both of which are typically consistent from quarter to quarter.

Go through your bank statements and add these less fun payments in. Do that and you’ll start to see the impact these have on your monthly take home, and fast.

We found pretty quickly that the cost of these un-fun regular payments were beginning to make a massive dent, and gave us a good idea of just where that money of ours was going.

Step 4: Think of petrol, groceries, and prescriptions

Now round up how much you might normally spend on things you can’t live without.

If you regularly spend $150 on groceries per week, add that in there. It’s an approximation, sure, but it gives you an idea of how much your weekly food is going to take out of your budget each month.

Do the same with prescriptions, with petrol, with nappies, and with any other costs you have to make weekly, fortnightly, or monthly. If you spend on apps, software, or anything else with a regular payment, throw those in, as well. Touch them and you’ll even see a detail for how much they cost you yearly.

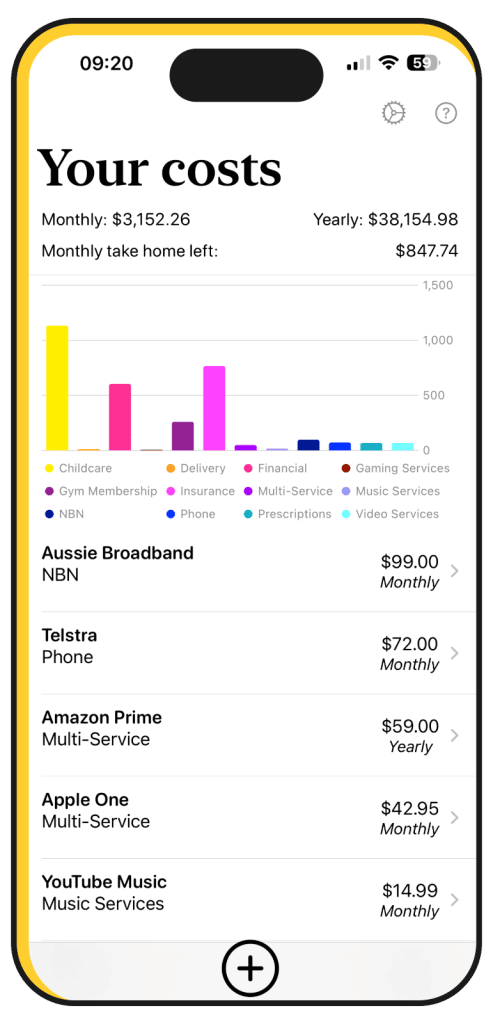

Step 5: Look at your monthly take home

Once everything has been added, you’ll get a firm picture of how much money you really have by checking out the first few lines of the app.

Under “Your costs” is:

- Your monthly spend

- Your yearly spend, and

- How much money is left from your monthly take home

If that last one is red, you’re losing money monthly, and you may want to do something to rectify it. That could mean looking through these budget items and working out what you don’t need monthly, taking out a video service, or even changing your plans.

The point is you can find it out by going through everything, and even seeing how much money you really have to play with each and every month.

From this point, you may want to throw some of that into a bucket for a rainy day, or even one for savings. In fact, you may want to factor that in with a financial item inside simplsaver, making sure all your money is accounted for, and your savings clear and visible inside an app only available for your eyes.