Trying to work out how much a new home will cost you isn’t just about the mortgage payments. What other costs should you think about?

If you’re about to jump into the world of owning your own home, congrats. Yes, it can be expensive, but also so rewarding. No longer do you need to ask if you want to paint a wall, hang a picture, or generally just do things in your home. And you can pay for your own home, because at the end of your mortgage repayment tunnel is an actual home you own. Huzzah!

However, there is that whole “payment” thing, and it goes beyond merely paying for the home. There’s your regular repayment, which can be weekly, fortnightly, or monthly, and it’s something banks and lenders will typically charge a little more on the top of, leaving you room to later on switch banks in a process known as refinancing. That’ll come later, but initially, you’ll need to think about how much you want to pay, and may want to consult a home loan calculator to work out the cost.

Home buying costs go beyond that regular repayment, though, as all home buyers eventually learn. There are parts that add up to how much you’ll need to spend, and it’s something simplsaver can help you understand with your first five costs. It’s one reason why simplsaver can be a crucial tool in the first home buyer’s journey.

So what are the first five costs first home buyers should be considering?

Mortgage repayment

This one is pretty obvious. If you know what you want to spend, you can quickly check out the cost broken down on a home loan calculator, or even use a repayment schedule to see how much the home loan is going to cost you long term.

If you already have pre-approval for what you can spend on a home or unit, you already know the broad number you’re working from. Now you just need to find out what your regular mortgage repayment is going to look like.

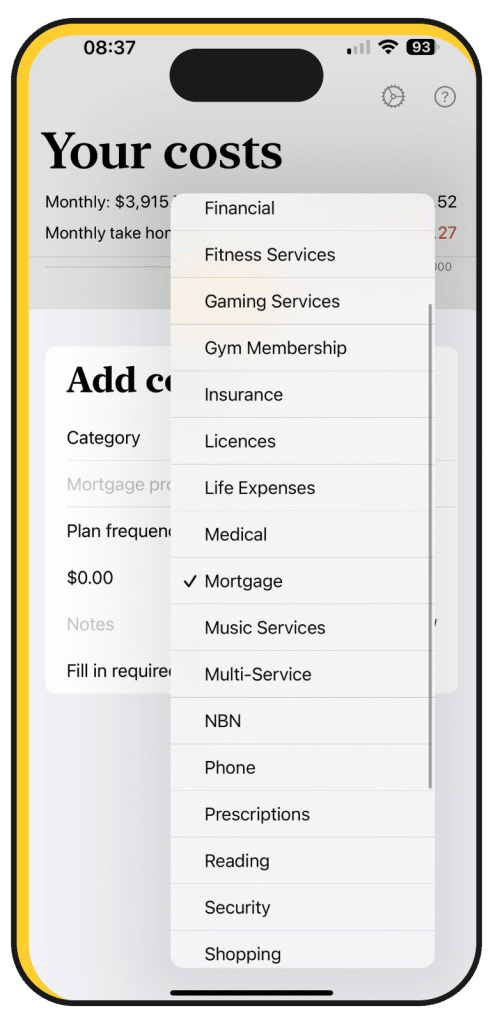

In simplsaver, you can add that cost under the “Mortgage” category, and even enter the bank or lender you’ll be getting it from. If you want to throw anything in notes, consider writing whether it’s a fixed or variable loan, and maybe the rate. It’ll remind you what you’ll be refinancing from later on if you decide to negotiate with your lender or switch to someone else.

Home Insurance

Whether you buy home and contents insurance or just straight up home insurance sans contents, this is one of those costs that’ll become regular with home buying that you may not think about.

A quick search for “home insurance quotes” on Google will give you a plethora of places to look at, and it’s something home insurance providers will detail based on your needs and where you live.

When we moved from the inner city to just outside of it, we found insurance rates dropped for both home insurance and car insurance, and the reason was interesting: the areas were safer, so the rates were lower. Comparing where you live on Microburbs may even provide a glimpse as to whether one place is safer than another, which may explain insurance price differences.

Run a quote on your next would-be home, and find out what you’d be paying monthly, and then add that potential cost into simplsaver under “Insurance”.

Water

Owning a home tends to come with the burden of utility payments, which isn’t quite as lucrative as owning the utility companies in Monopoly.

The good news is that water payments in parts of the country are done based on guesstimating, and typically provide the same number on a quarterly basis, at least until smart meters are installed everywhere. That will likely take time, at least based on what Sydney Water says, so guesstimation is what you can largely expect.

As such, you can get a pretty firm idea of what your water would be based on what you might already pay, or if you’ve never paid for water before, using an average water bill for your state, and hoping you come out under it.

In simplsaver, add in one of those averages under “Utilities”, and set the term to “Quarterly”, since that length is how water is typically paid for in Australia.

Electricity

Another utility you’ll need to factor in for your first home cost, it’s one we pay all the time, and like water, it’s another quarterly bill.

Regardless of whether you’ve owned a home before or not, if you’ve rented one, you’ve paid an electricity bill. And that means you have something to work with going to the next home, because chances are that you’ll be taking all your electrical gadgets with you to the next one.

So good news: you already have your average bill to work with. That might change, of course, dependent on if the home has air conditioning, if you change electrical providers, and if the home uses solar power or has a battery, but it’s a starting place, so throw that in.

This is another “Utilities” item in simplsaver: add your electricity and set the payment term to “Quarterly”, because that’s typically how we receive electrical bills in Australia.

Council Rates

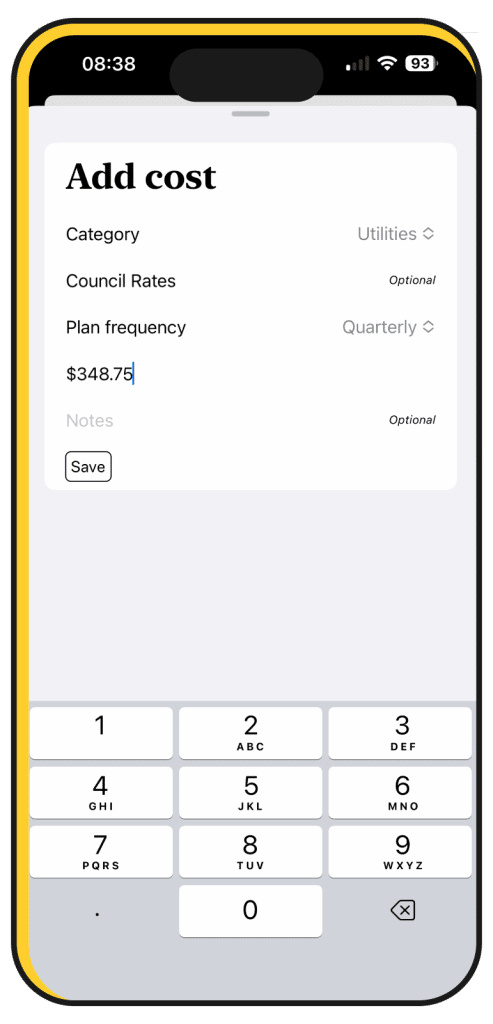

There’s one more cost for “Utilities” in simplsaver we can add, but it’s one you might need to ask the real estate agent for: council rates.

Every home owner pays rates, and these pay for waste management, among other things.

Unfortunately, you can’t typically find a council rates calculator from the council you’re moving to, so consider asking the real estate agent or vendor for a copy of what the rates are if it’s not supplied in any information when buying the home.

Once you have that, please throw that into simplsaver under “Utilities” with the term set to “Quarterly”.

Now set your regular take home

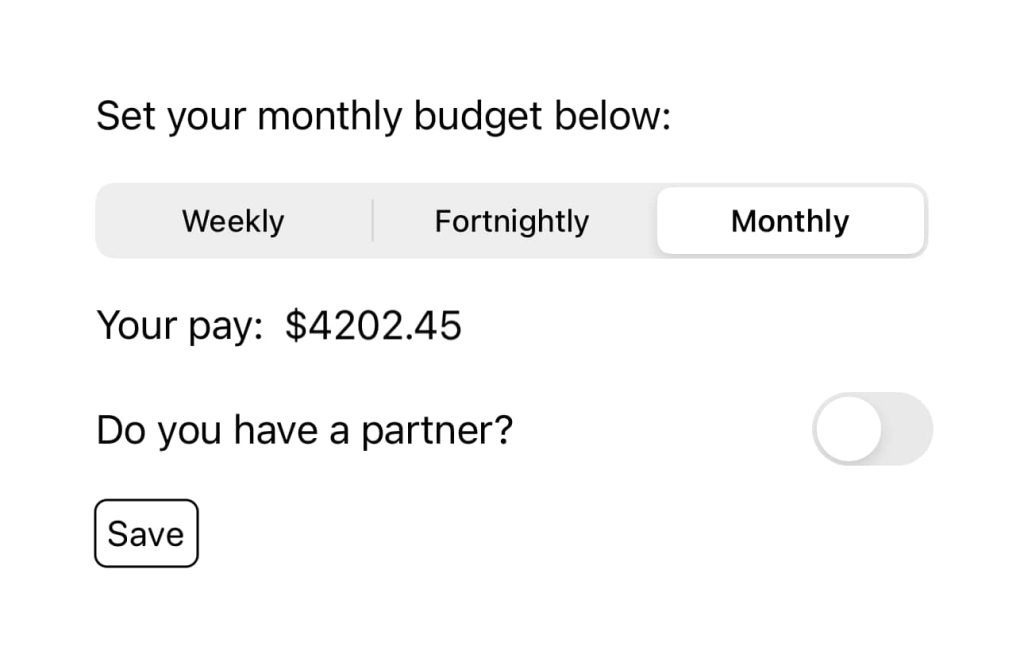

With all of that information, simplsaver will calculate the amount you’ll be paying.

Those quarterly payments will be smushed under a monthly amount (value divided by three, basically), but you’ll need to pay them eventually in a quarter, so factoring in those amounts is clearly important.

You can quickly find out how much you have left from what you get paid by heading into settings and adding your regularly weekly, fortnightly, or monthly salary.

Back in simplsaver’s main screen, the amount you’ll have left each month will be waiting for you.

Think of all the other regular costs

Even though your mortgage repayments, home insurance, water, electricity, and council rates are costs you’ll have to account for owning a home, there are plenty of others, and we can estimate the overall impact these have on your finances using simplsaver.

If you pay for video services such as Netflix, Stan, Foxtel, or Apple TV, throw them in. And if you pay for music services such as Spotify or Apple Music, throw them in, too. We can even calculate regular expected spends, such as if you know you need to spend $30 on nappies monthly, or $90 on petrol monthly, or even $100 on groceries weekly. Stick your NBN and broadband costs, because having the internet is nice, and consider adding the cost for your phone service, too. Throw all that in and let the system tell you how your finances are going to look.

Everything will be stored on your device and only on your device, and the outcome will be tailored to your specific needs. You’ll be able to find out whether you can afford your home and all the other things, and maybe even start working on a plan to reduce in areas to keep costs down long term.