There’s no shortage of budget apps, but you don’t need to be told you need a budget, because costs are already coming out. You need to find out what your budget is.

Before deciding to build a budget app, I tried desperately to find an app or solution that could help explain what my money was doing, and why it seemed to be disappearing every month.

Naturally, I ventured to the App Store to find a huge list of budget apps waiting.

Many of them were “free”, with the caveat that your data was the thing that made them so economical, and that made me uncomfortable. In an age where data leaks and breaches are becoming more frequent and regular, about the only place I wanted to have access to my banking data was my bank.

So free apps were out. Instead, I turned to paid apps, because they don’t use your data as the charge to use the app. They use your money for exactly that.

One of the apps it led me to was You Need A Budget, an app shortened to “YNAB”, which was one of the more popular budgeting apps. I’d heard about it from friends who said it helped them over the years, and figured it was worth a try, or even possibly a review, especially since I’ve been reviewing technology for over 15 years, including apps.

You Need A Budget (the app)

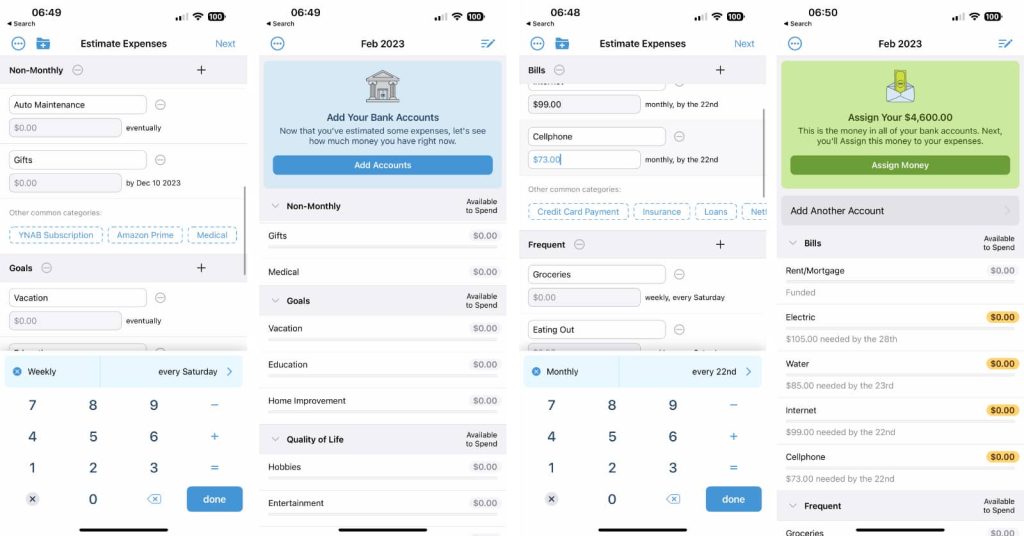

YNAB doesn’t bill itself on simplicity, and that’s probably a good thing. It’s an app to help you explain your budget by working out how much you have normally to assign to the buckets and categories that matter most.

You’ll start a budget with estimates on how much you would normally spend on the categories that matter — Rent/Mortgage, Electricity, Water, Internet, Groceries, Entertainment, and so on — and then you can either add a direct link to your bank account or throw your finances in manually if you don’t want that link to occur.

And from there, you assign what you need, working out how much money you have left, roughly when you need to have it by, and how much you’re basically allowed to have for each category. And if you don’t have enough, it will tell you if you’ve overspent.

The idea is to build a budget and the rules of a budget based on your needs and what’s important. Your housing is the most important aspect, and all the bills in your life clearly matter in that respect, so the rest of your budget is left to how much extra you can spend in other categories.

In theory, this all sounds good, and seems like an important way to teach the concept of what a budget is, applying those rules to your financial circumstances.

However, the more I tried using You Need A Budget, the more I worked out that it wasn’t for me.

The problems with You Need A Budget

One reason was the simplicity, or lack thereof.

YNAB isn’t remarkably easy to use, and requires more than a few minutes of your time. While you can choose whether or not it talks to your bank (yay!) and enter your costs manually (a slightly slower process for sure), even setting up the initial budget and buckets feels like it’s old school.

You will sit there, hand on phone for a few minutes trying to gauge your buckets if you don’t normally have a budget, or one you recognise as being existent.

When those buckets are complete, you can add someone to pay and what those charges are, but none of it is really filled in for you. The services you could never remember the price of are just empty line items free for you to enter how much you think you need to spend. You might never remember some of the details, but everything is a blank item waiting to be entered.

YNAB is very much a budget to make while looking at your bank statement line by line, and while that’s fine for some, it wasn’t for me.

The amount of time being spent on building a budget in YNAB was exactly why I was having trouble understanding my budget, and it wasn’t telling me much.

Like so many people, I already had next to no time to build a budget, and YNAB wasn’t making that any easier. It was marginally faster than compiling a spreadsheet myself, but not by a whole lot.

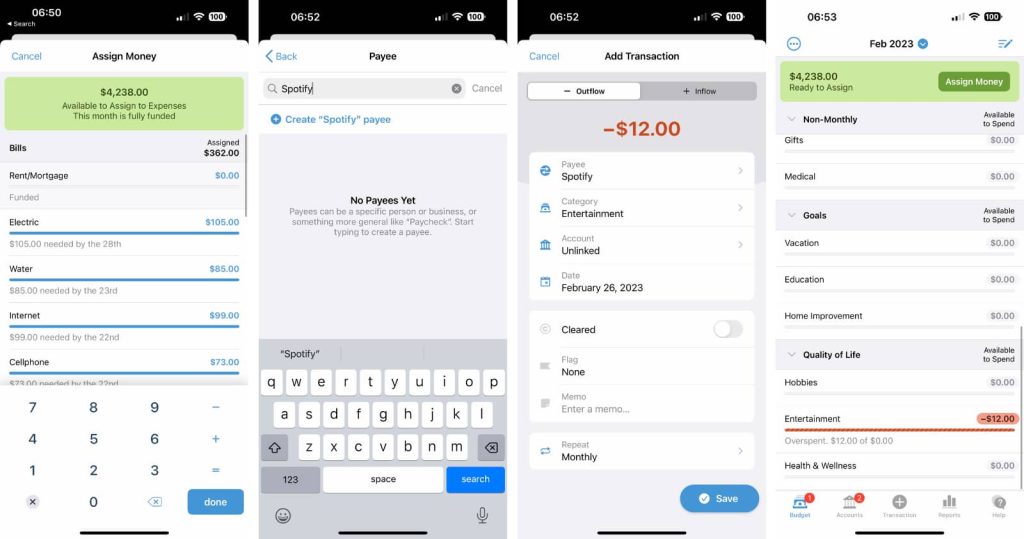

The price to use YNAB was also pretty hefty, and that didn’t grab me.

In Australia, YNAB costs either 21.99 per month or 144.99 each year. Obviously the yearly cost is technically better value, but both are very expensive.

I didn’t want my choice of budget app to erode my finances and hinder them further.

I wanted a budget app to help my finances. I wanted a budget app to help me become aware of where my costs were going and didn’t feel like it would affect my budget in an obvious way. Twenty bucks monthly or near $150 a year isn’t far off what I pay for entertainment services, and that was incredibly hard to justify for an app to tell me where my money was going.

The realisation: you have a budget

One of the problems with budget apps like YNAB is that you need to train the app into being aware of what your budget is, and that makes a lot of sense: without your financial information — debits, mostly — a budget app is basically a spreadsheet system and calculator with no spreadsheets or way of calculating anything. It needs information and items to work.

But You Need A Budget was trying to wrap my finances to a budget as if it didn’t already exist, and that’s a problem I don’t think its makers thought of. It implied I didn’t have a budget, when the reality is we all have budgets already, we just might not like the outcome or even be aware of what they’re doing.

You might not actively be aware of your budget, but if you have money in the bank and bills coming out, you already have a budget. It mightn’t be the budget you want, but you can change that.

What I needed was a way to force my budget into an app and see where all the money was going. I needed to work out what my budget was doing to discover where the money went.

Making things simple

To do this, I built my own approach for a budget app. It had to be easy to use, efficient, and cost-effective, the three things that I thought YNAB was failing at.

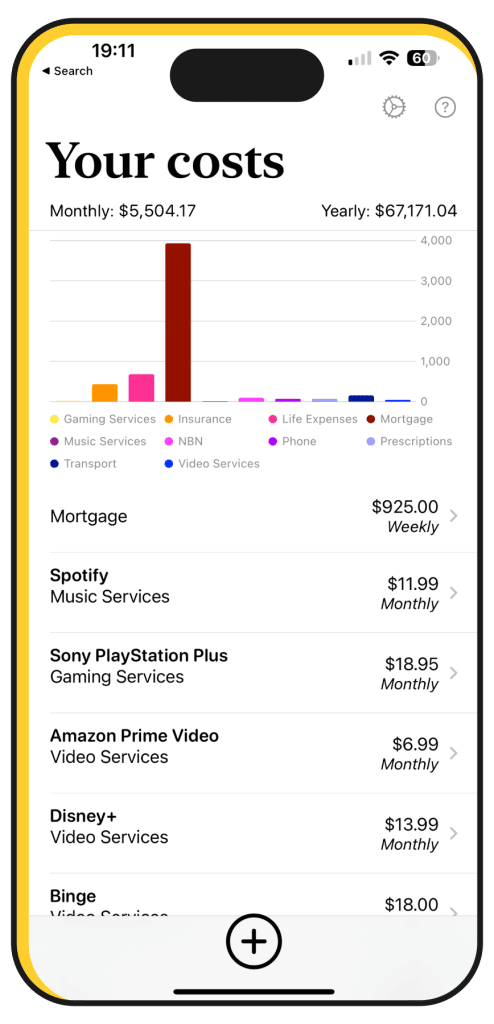

The result is simplsaver, a budgeting app you can use to build your current budget in 60 seconds, and have it provide an explanation of your budget based on what you feed it.

Designed to be simple in every way, it asks for your salary — or two if you’re budgeting in a couple — and your costs, and it will provide details on how much you’re spending monthly and how much of that budget you have left to use. That’s as simple as it gets.

We’ve also made it cost effective, because instead of feeling like it can take serious money out of your bank, simplsaver instead costs below $10 for a year. Essentially, it’s the equivalent of buying its developer a drink for helping your budget.

And it’s also all about privacy, because in an age where data breaches happen, your financial data should be all yours. So simplsaver stores everything on your phone. It’s why our privacy policy is so minimalist.

An app for those without budgets, and even for those with one

It’s important to note that there are lots and lots of budget apps on the App Store, and you should be able to make your budget fit many of them.

There are different ways to budget and various rules you can use to work out how to manage your money, and so no one budget app is likely to be better than the rest. They can all help you budget, but finding the right app for you comes down to what you’re looking for.

With simplsaver, we wanted the app to fit some rules that others were missing, making it:

- Easy

- Efficient

- Economical, and

- Private

Our app is still growing and we’re adding features to simplsaver regularly making it more than just a modern pen and paper budget, so check it out and tell us what you think.