Private school fees aren’t cheap, but they might just give an indication as to where your money is going.

There was a story this weekend about private education prices going up in Sydney, as schools hit parents with price rises. Everything is going up, of course, so it’s hardly a surprise, but reading about it on the Herald, some of these rises are pretty significant.

Costs are pushing past the $45K mark per year for some schools, making for a costly time if you have one private school child, and even more hefty time if you have two or three.

While that won’t be easy for the parents that send their kids, it might be a time to factor in the cost of education and compare it against everything else.

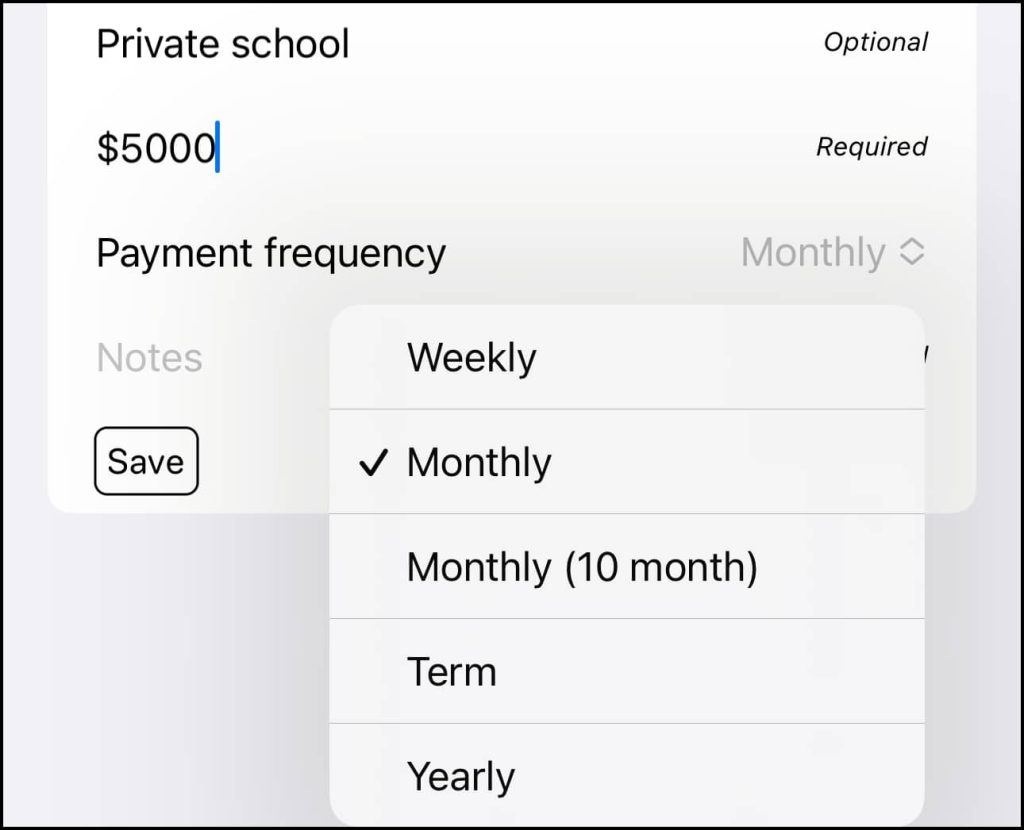

Add education in your simplsaver app

A feature we’re adding this week will make it possible for you to do just that: add education fees.

These can understandably get costly, and they may offer different payment terms, too. You might be paying for education weekly, or monthly, or it’s even possible to plonk down a huge chunk of money in one big sum yearly.

In either situation, the damage to your budget can be hard to see, so adding this sum to simplsaver means seeing the impact education fees have on your overall take home each month.

Useful for more than just private school

While private school tuition fees are the likely approach for Education in simplsaver, we can see other uses within the Education category.

University fees that are regular, or yearly fees for a PhD. You might even have education you choose to pay for, though keep in mind that simplsaver works best when the cost is regular.

And if you expect to have yearly education supplies, such as a thousand bucks on uniforms and backpacks over the course of a year, you might decide to throw that in there, as well.

All of this can add up pretty quickly, and these costs can become the sort of thing that sends your budget into red territory, where you’re losing money and you’re not entirely sure why.

Fortunately, it’s an area where simplsaver can help, giving you an explanation as to what’s going on in your budget, and hopefully a way to work out what to cut back on next.